Comprehensive Guide to Special Economic Zones (SEZs) in India: Benefits, Policies, and Impact

When you hear the term “special economic zones”, what immediately comes to your mind?

The first thing that crosses my mind upon hearing “Special Economic Zone” is, “What makes it so special?” It sounds like a location suited for something extraordinary, such as an entrepreneurial powerhouse or an innovative province where operations run differently.

It can be about better opportunities, big industries, or something futuristic that makes SEZ stand out. Since it seems like it might be a key component of the economy, I would absolutely like to learn more.

Understanding SEZ

Imagine a vibrant, idea-driven place where companies expand quickly, commerce and exports rise, and the economy receives a significant boost .This is the main goal of Special Economic Zones (SEZs) in India; it’s not just a distant goal. These areas are providing our nation with a glimpse of a promising and exciting future while also strengthening India’s economy.

An SEZ is an approved region within a nation where the government grants special benefits and flexible principles in order to attract businesses. In short, it’s like giving firms a head start by reducing bureaucracy, minimizing taxes, and improving infrastructure. As they operate with the mindset that they are different from the rest of the country in terms of taxes and customs, businesses in these zones can focus on making goods for export without becoming concerned about a lot of restrictions.

India’s Special Economic Zones: What Are They?

India has established SEZs to encourage economic development and build the country’s financial system. Since these zones have different policies than the majority of the country, industries can operate there with greater freedom. Hence, the companies here focus on boosting exports, bringing foreign investment, providing employment opportunities, and improving the local standard of life. India has established SEZs to encourage economic development and build the country’s financial system. Since these zones have different policies than the majority of the country, industries can operate there with greater freedom. Hence, the companies here focus on boosting exports, bringing foreign investment, providing employment opportunities, and improving the local standard of life.

SEZs are governed in India by the Special Economic Zones Act, 2005. This law was enacted to encourage trade and investment in an orderly manner. India did not have proper Special economic zone concept before SEZ act in 2005. Instead, it had an Export Processing Zone (EPZ), which was ineffective at attracting new firms. An alternate approach with more success was Special Economic Zones (SEZ).

Why Were SEZs Created in India?

Purpose of Setting Up SEZ in India

India required a strategy to boost its economy and compete in the global market. SEZs were created to:

(1) Increase Exports: By enabling businesses to create goods that can be sold internationally.

(2) Lure Foreign Investments: Through providing a favourable environment for foreign enterprises.

(3) Generate Employment: Establishing industries that create jobs

(4) Support Local Development: Where they are building up regions that were not so great

How Do Special Economic Zones Operate?

SEZs work by offering advantages to companies that establish their activities here. The major components are as follows:

- Tax Advantages: For an agreed upon period of time, businesses in SEZs are exempt from paying various taxes. This saves their expenses for operations and drives them to increase their investment.

- Simplified Rules: The government makes it simpler for businesses to start and operate by reducing the number of paperwork and approvals necessary.

- Better Infrastructure: SEZs usually include cutting-edge infrastructure to support enterprises, constant electricity, and well-built roads.

- Customs-Free Zones: The main purpose for products produced within SEZs is export. Businesses are exempt from paying charges on imports and raw materials used for creating their goods, since these areas are regarded as being outside of India’s customs area of expertise.

- Single-Window Clearance: Businesses save time and effort by using a single system to handle all necessary permits and approvals for operations.

Examples of SEZs in India

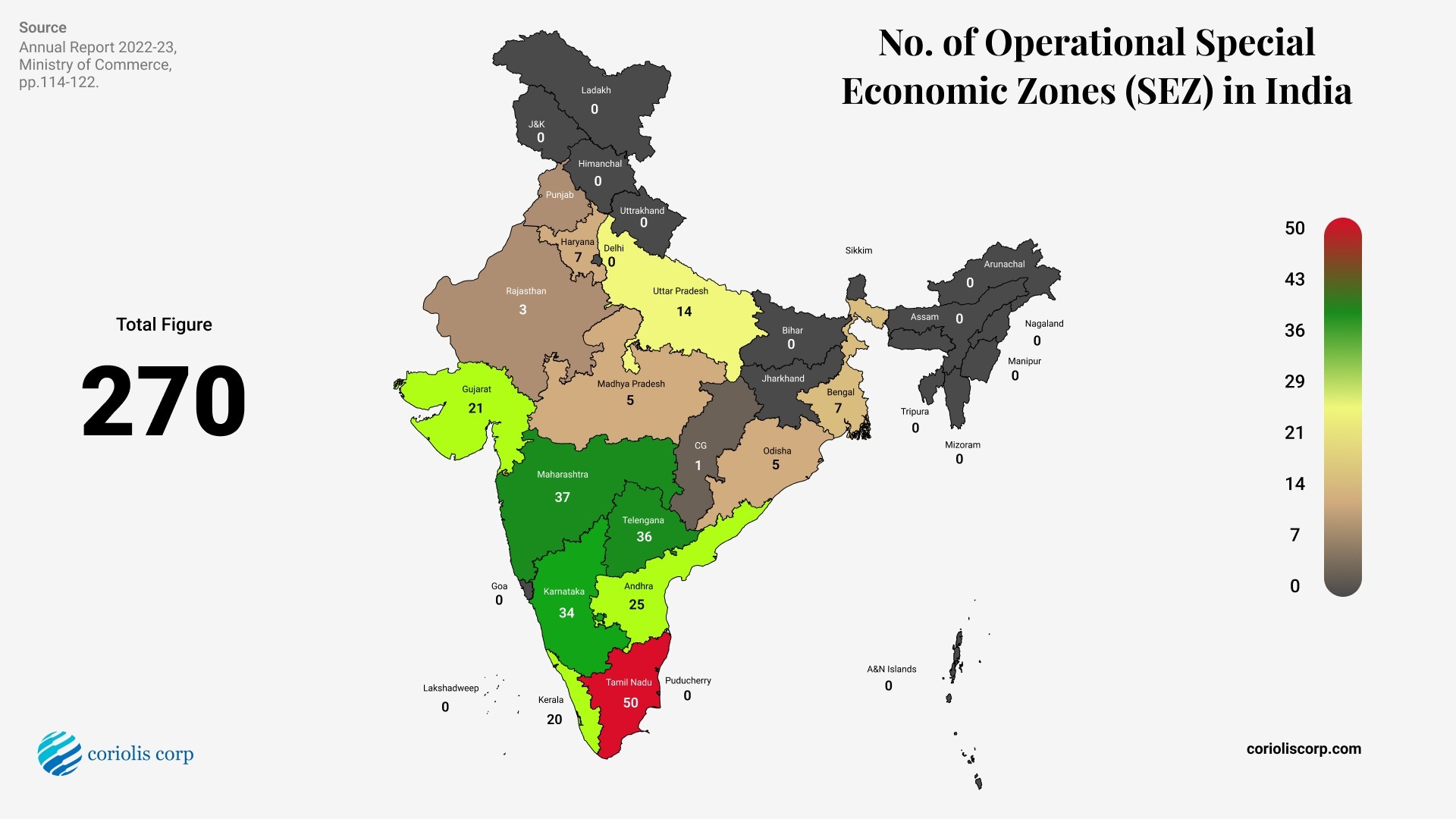

India has a number of SEZs distributed among its many states. Here are a handful of known examples:

- Kandla SEZ (Gujarat): India’s first SEZ, a vital hub for exports.

- Mundra SEZ (Gujarat): Developed by the Adani Group, known for its port-based industries.

- Noida SEZ (Uttar Pradesh): Focused on electronics and IT manufacturing.

- Chennai SEZ (Tamil Nadu): A center for electronics and automobile industries.

- Infosys SEZ (Bangalore): Specializing in IT services and software exports.

- SEEPZ (Mumbai): Specializes in gems, jewelry, and electronics.

- Cochin SEZ (Kerala): Known for its multi-product focus and strategic location.

- Visakhapatnam SEZ (Andhra Pradesh): A hub for IT and multi-product industries.

- Surat SEZ (Gujarat): Specializes in diamond and textile exports.

- Mahindra World City SEZ (Tamil Nadu): Known for IT, apparel, and auto ancillaries.

- Moradabad SEZ (Uttar Pradesh): Focused on handicrafts and art exports.

The Future of SEZs in India:

The government must address these issues if SEZs need to remain achievable. Here are some measures that can be helpful:

(1) Improving Policies: Making sure that policies are clear and stable with a view to boost organizations confidence.

(2) placing Sustainability First: Creating SEZs in an environmentally friendly way.

(3) Providing Skilled Workforce: Educating community members to satisfy the growing needs of SEZ industries.

(4) Encouraging Domestic Businesses: Assisting Indian businesses in collaborating with foreign investors in SEZs.

In conclusion,

India’s strategy for economic growth heavily depends on its Special Economic Zones. SEZs have been contributing to growing exports, investment, and creation of employment by providing firms with a favourable operating environment. For them to reach their full potential, though, they must overcome the barriers they face while simultaneously making sure they continue to be relevant in the ever-changing global economy. SEZs have the potential to transform the economy of India, and with the proper strategies and regulations, they can continue to be vital to the economic development of the entire country.